Banking has entered a new era. The old-style bank with its long queues, paperwork, and restricted time is not the only choice. Customers today are demanding speed, convenience, and transparency. That’s where neobank apps come into play. For entrepreneurs and enterprises, this guide explains what neobanks are, how they work, the benefits of creating one, and most importantly, how businesses can grow by investing in Neobank app development.

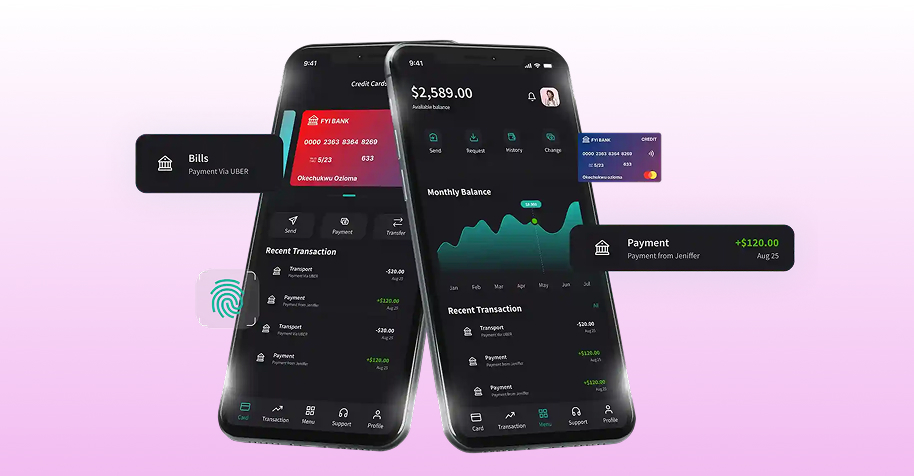

Think about the possibility of handling your finances without having to enter a bank branch. There is no paper, no line to stand in, no old-fashioned interfaces; a simple app allows opening an account, transferring money, spending it, and even investing, all with a few clicks.

That is what neobanks provide. They have transformed the meaning of banking for the digital-first generation.

With a growing number of people moving to mobile banking, companies are coming to recognize that starting a neobank app is not a possibility, but a growth initiative. However, what is a neobank app, what does it do, and how much will it cost to create one? Let’s explore step by step.

What is a Neobank App?

Fundamentally, a neobank app is a banking service designed for the digital age. Neobanks exist solely online, unlike conventional banks that utilize physical branches. All services, such as opening an account, payment of bills, and credit application, are all done within the app.

The magic of a neobank lies in its simplicity. Users don’t have to deal with confusing menus and unknown charges. Rather, they receive open, easy-to-use systems that enable them to directly have financial control in their hands. This simplicity is what customers are looking for when it comes to businesses.

Business Models of Neobank Apps

Not all neobanks operate the same way. Some work alongside licensed banks, others run independently, and some act as platforms connecting users with third-party financial products.

- The partnership model is the most common. Here, the neobank app offers a sleek user interface and experience, while a traditional bank provides the licenses and infrastructure in the background.

- The full-stack model is more ambitious. These neobanks apply for their own licenses and operate like independent banks, giving them more control but also more regulatory responsibility.

- Finally, the platform model focuses on aggregation. These neobanks provide an exchange of financial services in the form of insurance, loans, and investments, without necessarily offering all of them directly.

The decision to get a model depends on what you want to achieve in business, the area you are operating and how much you are willing to invest in compliance.

Also Read: Future of Finance: How Fintech Trends are Solving Key Banking Challenges

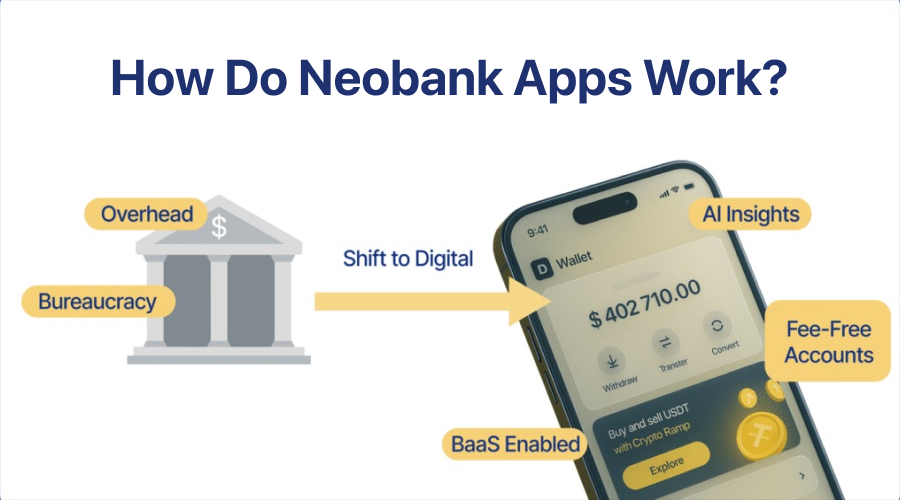

How Do Neobank Apps Work?

Neobank apps are driven by powerful technology behind a simple and clean user interface. Cloud infrastructure makes them scalable. APIs link them to financial institutions, credit bureaus, and payment systems. And powerful encryption secures user information.

Digital KYC (Know Your Customer) checks authenticate the identity of a customer within a few minutes when the customer signs up. When it is approved, they may open an account, deposit money, and use the application as any other bank. Payments are made instantly, expenditure is monitored instantly, and insights are shown in simple visuals to comprehend.

On the user side, it is smooth. However, in the case of businesses, this seamless experience is achieved through careful Neobank app development.

Why Should You Invest in Neobank App Development?

The move to digital banking is not slowing down. Indeed, analysts estimate that the neobanks will be taking up an enormous portion of the global banking sector within the coming years.

This is a chance that a business cannot afford to miss. By investing in a neobank app, you not only meet rising customer demand but also gain a competitive edge over slower traditional institutions.

You also cut down on physical infrastructure costs. Instead of building branches, your investment goes into technology and user experience. This means higher scalability at lower overhead.

Above all, you establish a personal connection with customers. All interactions happen within your app, which creates a powerful data source to enhance services and increase engagement.

Also Read: Digital Payment Apps: How Technology Simplified Money Transfers

Benefits of Developing a Neobank App

The advantages are more than just convenience. Here are a few that stand out:

- Customer loyalty: Customers remain loyal to the services that help them save time and money. An effective neobank application simplifies day-to-day banking.

- International presence: You can enter new markets more quickly than normal banks without having branches.

- Content-based expansion: Neobank apps collect information about customer behavior. You are able to use analytics to tailor services and create superior deals.

- More rapid innovation: It is easier to update an app than to modernize a traditional bank. You will be able to add features to stay ahead of the competition.

To businesses, these benefits mean increased profitability and long-term expansion.

Key Features of a Successful Neobank App

The features of a neobank app determine its success. Essential ones include:

- Online account opening and fast verification.

- Convenient money transfers and billing.

- Artificial intelligence-based financial insight and budgeting.

- Biometric authentication with multiple security layers.

- In-app chat and AI support for customers.

- Record keeping on smarter expenses.

- Merger with investment and lending service.

All these elements add to user experience and trust, which is essential in digital finance.

Also Read: Why Choose WeeTech as Your Ideal Enterprise Software Development Company

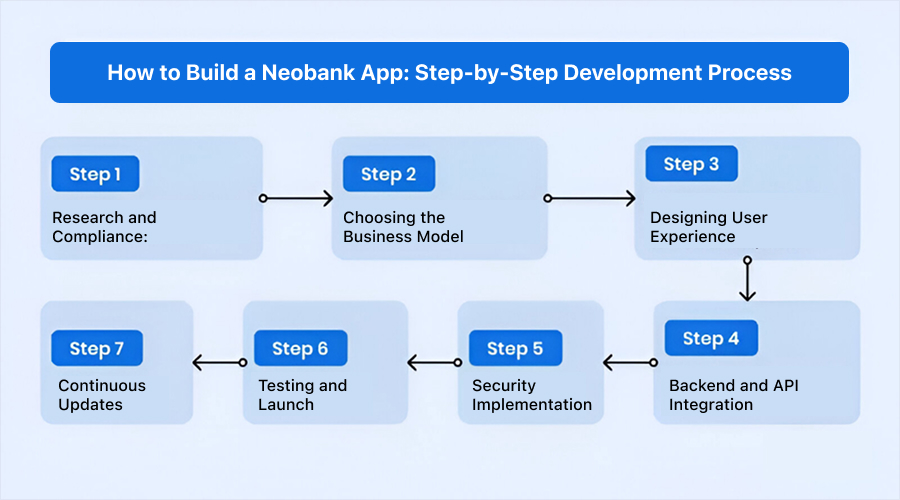

How to Build a Neobank App: Step-by-Step Development Process

Developing a neobank app should be a well-planned process. It generally involves:

1. Research and Compliance:

Begin by researching your target market and regulatory requirements. Neobanks handle sensitive data, so there is no bargain when it comes to compliance.

2. Choosing the Business Model

Choose whether you will collaborate with the current banking or go on your own. Such a decision determines the whole process of development.

3. Designing User Experience

Follow minimal and instinctive design. Neobanks thrive as they eliminate friction in conventional banking.

4. Backend and API Integration

Build a powerful backend system that is able to process high-volume transactions safely. APIs play an important role in communicating with third-party services and financial institutions.

5. Security Implementation

Enhance user security with sophisticated encryption, multi-factor authentication, and fraud detection.

6. Testing and Launch

Do a lot of testing to be reliable and compliant. When ready, roll out the app with powerful onboarding campaigns.

7. Continuous Updates

The digital finance market is developing at a rapid pace. It needs to be competitive by making regular updates and improvements in features.

What is the Cost of Neobank App Development?

The neobank app development cost is one of the largest questions that businesses ask.

The fact is that prices differ a lot. A simple MVP that has key functionalities such as account creation, payments, and basic analytics will cost approximately, $150,000 – 200,000. Neobanks in their full-fledged version with more advanced AI, multi-currency services, and investment options can cost more than $400,000 – 500,000.

Here is a basic cost breakdown to make it clearer:

| App Type | Features Included | Estimated Cost Range | Timeline |

| MVP (Minimum Viable Product) | Basic account opening, payments, transaction history, and simple analytics | $150,000 – $200,000 | 4–6 months |

| Mid-Level App | Advanced security, budgeting tools, in-app support, third-party integrations | $250,000 – $350,000 | 6–9 months |

| Full-Featured Neobank App | AI-driven insights, multi-currency support, investments, credit/lending, global compliance | $400,000 – $500,000+ | 9–12 months |

Besides development, you must also budget for compliance, licensing, and post-launch support. It is unsafe to cut corners in this since banking applications deal with sensitive financial information.

Although the initial investment might appear to be high, the return on investment is actually significant if you are able to capture the market share and create a loyal customer base.

Why Choose WeeTech as Your Neobank App Development Partner?

Not all development companies know the specifics of fintech. That is why it is important to find the right partner.

WeeTech is an established Mobile App Development Company with a track record in developing secure, scalable, and user-friendly financial applications. Our team is aware of the technical and regulatory issues of developing a neobank app.

We do not simply create apps but growth engines for businesses. Being professional in compliance planning to UI design, and backend development, all stages are approached with professionalism. WeeTech is not merely a vendor but a partner that is dedicated to your success.

Conclusion

Banking is going through a transformation, and neobank applications are at the forefront. They are fast, flexible, and convenient, which are the expectations of modern customers. To businesses, the development of Neobank apps is an effective approach to open new opportunities, build stronger customer relationships, and grow on a global scale.

However, success depends on your approach: the model to use, the features incorporated, and having a stable partner. That’s where WeeTech comes in. Being a reputable Mobile App Development Company, we make sure that your app is safe, future-proof, and growth-oriented.

Your next big move in digital finance starts here. Contact Us Today! WeeTech is ready to bring your vision of a world-class neobank app to life.